Auditing and Assurance Services 16th Edition Chapter 1 Free Pdf

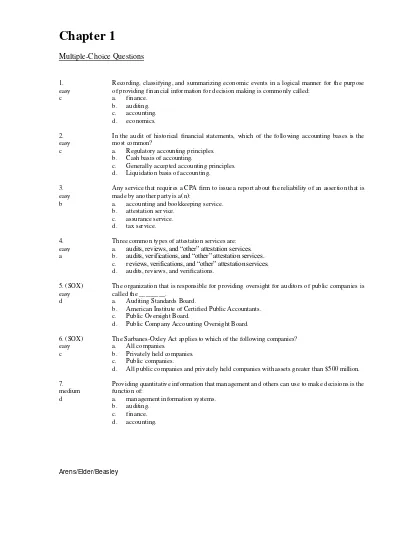

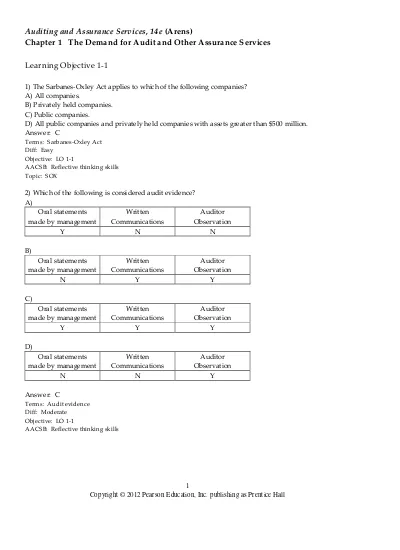

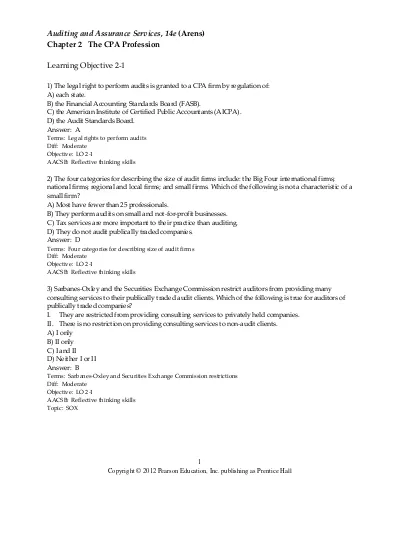

Test Bank with Answers for Auditing and Assurance Services 13e by Arens Chapter 1

The role of accountants is to record, classify, and summarize economic events in a logical manner for the purpose of providing financial information for decision making. To do this, accountants must have a sound understanding of the principles and rules that provide the basis for preparing the financial information. In addition, accountants are responsible for developing systems to ensure that the entity's economic events are properly recorded on a timely basis and at a reasonable cost.

8 Baca lebih lajut

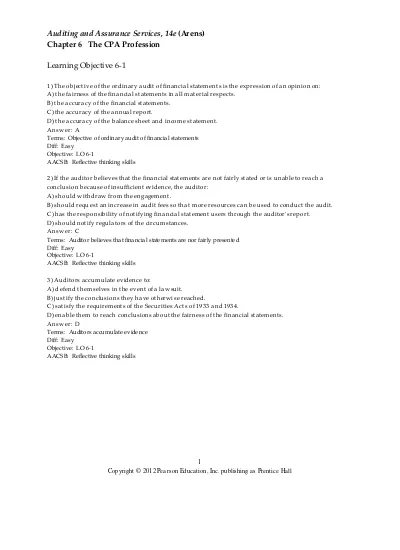

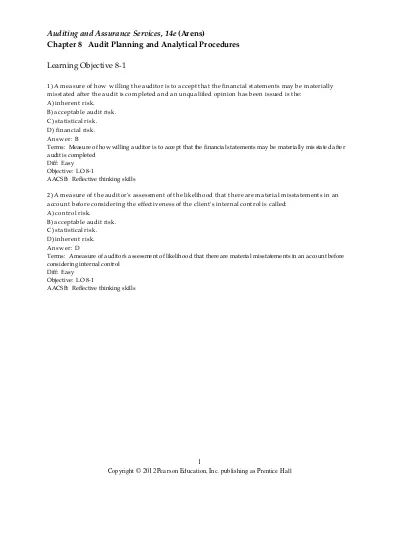

Test Bank with Answers for Auditing and Assurance Services 14E by Alvin A Arens and Randal J Elder chapter 6

statements are free of material misstatements. The standards also recognize that fraud is often more difficult to detect because management or the employees perpetrating the fraud attempt to conceal the fraud. Still, the difficulty of detection does not change the auditor's responsibility to properly plan and perform the audit to detect material misstatements, whether caused by error or fraud. The auditor's responsibility for uncovering direct - effect illegal acts is the same as for errors and fraud. However, the auditor is not required to search for indirect - effect illegal acts unless there is reason to believe they exist. Te rms: Auditor responsibilities for discove ring material errors, mate rial fraud, dire ct - effect ille gal acts, and indirect - e ffect ille gal acts

Baca lebih lanjut

34 Baca lebih lajut

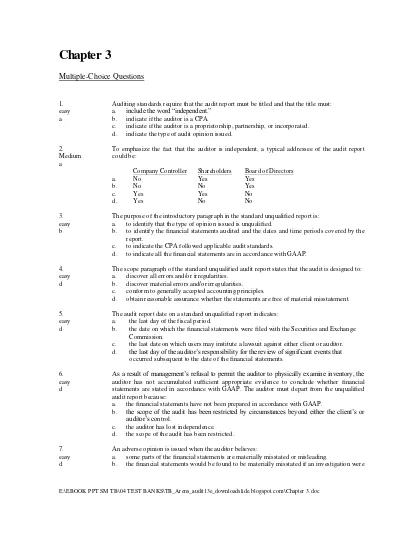

Test bank Auditing and Assuarance Services 13h Arens Chapter 3

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

Baca lebih lanjut

29 Baca lebih lajut

Test Bank with Answers for Auditing and Assurance Services 14E by Alvin A Arens and Randal J Elder chapter 1

The role of auditors is to determine whether the recorded information prepared by accountants properly reflects the economic events that occurred during the accounting period. Because U.S. or international standards provide the criteria for evaluating whether financial information is properly recorded, auditors must thoroughly understand those accounting standards. In addition to understanding accounting, the auditor must possess expertise in the accumulation and interpretation of audit evidence. It is this expertise that distinguishes auditors from accountants. Determining the proper audit procedures, deciding the number and types of items to test, and evaluating the results are unique to the auditor. Terms: Roles of accountants and auditors

Baca lebih lanjut

15 Baca lebih lajut

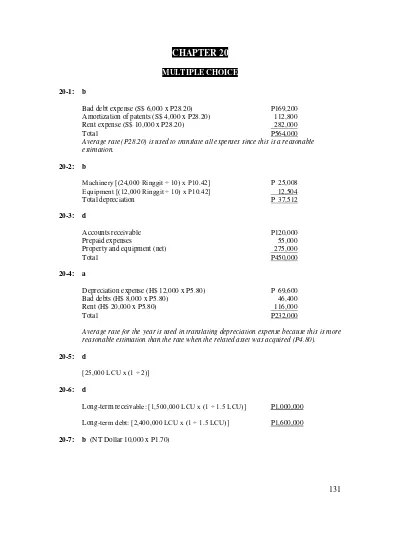

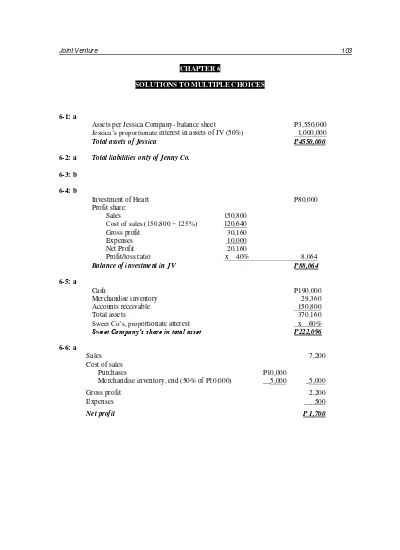

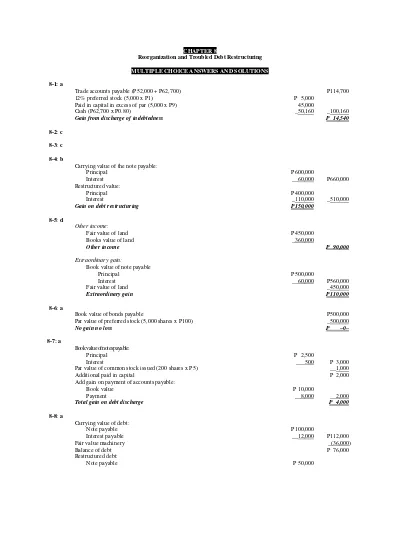

Solution Manual and Test Bank Advanced Accounting by Guerrero & Peralta CHAPTER 20

Investment in Subsidiary account, Jan. 1, 2005 P1,600,000 Share in subsidiary net income [(800,000 yen x 70%) x P.57] 319,200 Translation adjustment (P25,000 x 70%) 17,500 Share of subsidiary dividends [(50,000 yen x 70%) x P.59] ( 20,650) Investment in Subsidiary account, December 31, 2005 P1,916,050

11 Baca lebih lajut

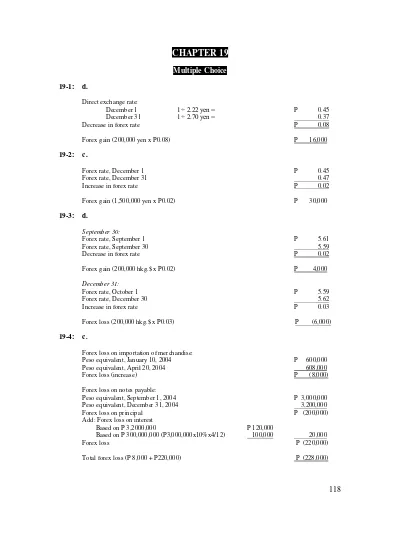

Solution Manual and Test Bank Advanced Accounting by Guerrero & Peralta CHAPTER 15

> '> (> 1> 9> A> B> N> V> W> a> i> q> r> ~> †> ‡> Ÿ> §> ¨> ©> ´> ¶> ·> ¸> ¹> º> »> Ç> È> É> > Ó> Ô> ß> à> è> é> ï> û> ? ? ? ? ? ? ? ? ? ? ? ? "? #? $? % ? &? '? (? 9? A? I? J? K? S? T? b? c? k? w? x? €? ? – ? ¡? ¢? £? ¤? ®? ¯? Ä? Å? Í? Ø? Ù? Ú? Û? è? é? ñ? ü? ư? ₫? ÿ? @ $@ %@ &@ '@ 1@ 2@ L@ M@ U@ `@ a@ b@ c@ |@ }@ ~@ •@ €@ @ ‚@ œ@ @ @ «@ ¶@ ¾@ ¿@ Æ@ @ Ú@ æ@ @ ü@ ư@ ñB óB ơB ÷B C C C C C %C -

Baca lebih lanjut

194 Baca lebih lajut

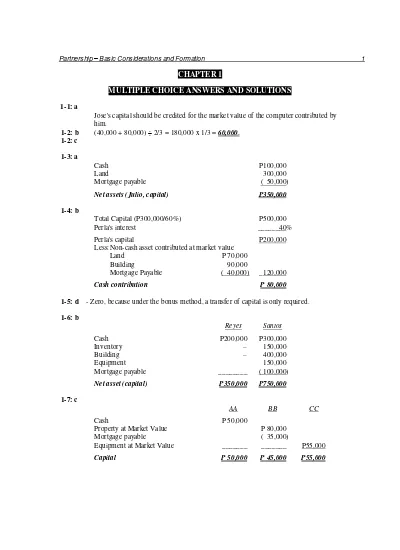

Solution Manual and Test Bank Advanced Accounting by Guerrero & Peralta 2 CHAPTER 01

Notes Payable ........................................................................ 4,000 Accounts Payable................................................................... 10,000 Accrued Interest Payable ....................................................... 100 Allowance for Bad Debts ....................................................... 1,200 Accumulated Depreciation – Furniture and Fixtures ............. 1,400 Pedro Castro, Capital ............................................................. 30,135

19 Baca lebih lajut

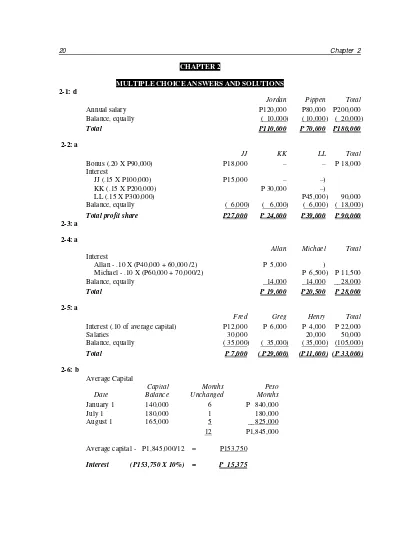

Solution Manual and Test Bank Advanced Accounting by Guerrero & Peralta CHAPTER 02

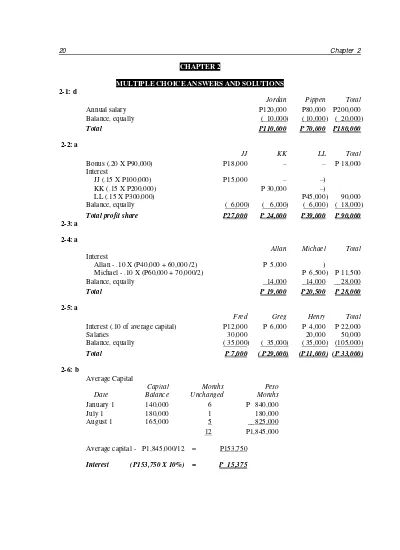

Balances, Jan. 1................................... P 80,000 P120,000 P180,000 P380,000 Additional Investment ........................ 20,000 – – 20,000 Capital Withdrawal ............................. – – ( 30,000) ( 30,000) Net Income.......................................... 22,333 22,733 24,934 70,000 Drawings ........................................... ( 10,000) ( 10,000) ( 10,000) ( 30,000) Balance, Dec. 31 ................................. P112,333 P132,733 P164,934 P410,000

22 Baca lebih lajut

Solution Manual and Test Bank Advanced Accounting by Guerrero & Peralta CHAPTER 05

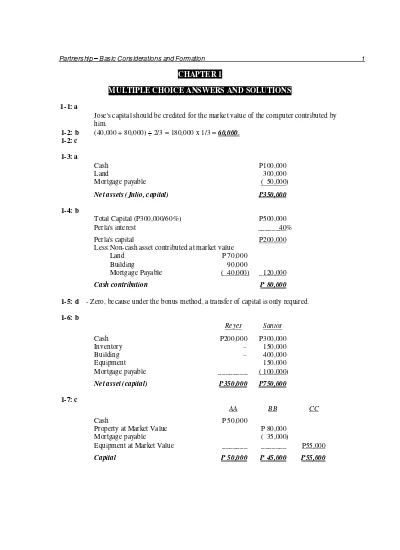

partnership is P485,000 + P175,000 = P660,000. A one-sixth interest in the partnership is P660,000 x 1/6 = P110,000. Using the bonus method, we compute a bonus of P175,000 – P110,000 = P65,000. Using the 2:3 profit sharing ratio, the amount allocated to Jenny is P26,000 (2/5 x P65,000) and the amount allocated to Kenny is P39,000 (3/5 x P65,000).

20 Baca lebih lajut

Solution Manual and Test Bank Advanced Accounting by Guerrero & Peralta 2 CHAPTER 02

Balances, Jan. 1................................... P 80,000 P120,000 P180,000 P380,000 Additional Investment ........................ 20,000 – – 20,000 Capital Withdrawal ............................. – – ( 30,000) ( 30,000) Net Income.......................................... 22,333 22,733 24,934 70,000 Drawings ........................................... ( 10,000) ( 10,000) ( 10,000) ( 30,000) Balance, Dec. 31 ................................. P112,333 P132,733 P164,934 P410,000

22 Baca lebih lajut

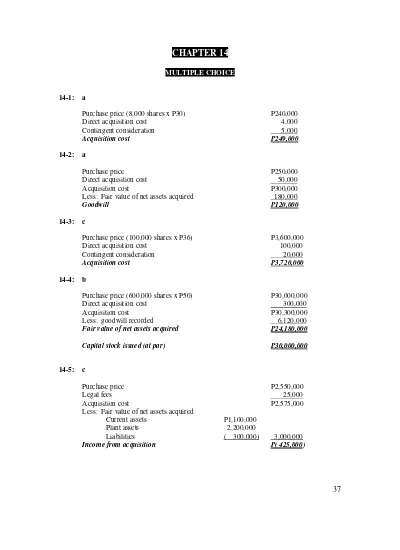

Test bank of Advanced Accounting by Guerrero & Peralta CHAPTER 1

Allowance for Bad Debts ............................................................. 12,800 Accumulated Depreciation – Delivery Equipment ...................... 8,000 Accumulated Depreciation – Fixtures .......................................... 91,200 Accounts Payable ......................................................................... 64,000 Notes Payable ............................................................................... 40,000 Accrued Taxes .............................................................................. 8,000 Sales, Capital ................................................................................ 224,000

Baca lebih lanjut

19 Baca lebih lajut

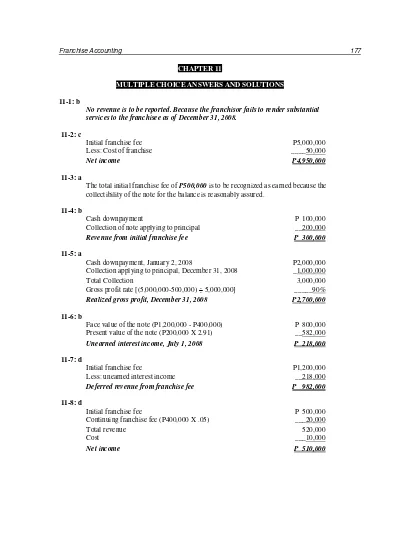

Solution Manual and Test Bank Advanced Accounting by Guerrero & Peralta 2 CHAPTER 11

Dates of Revenue Recognition: ..................................................... Types of Revenue January 12, 2008 ............................................................ Sale of equipment June 1, 2008 ................................................................... Sale of inventory July 1, 2008 .................................................................... Initial FF (as adjusted0 June 30, 2009 ................................................................. Interest income and

11 Baca lebih lajut

Auditing and Assurance Services 16th Edition Chapter 1 Free Pdf

Source: https://123dok.com/title/test-bank-answers-auditing-assurance-services-arens-chapter

0 Response to "Auditing and Assurance Services 16th Edition Chapter 1 Free Pdf"

Post a Comment